Best Machine Learning Techniques in Forex Algorithm Trading

The implementation of machine learning methods into trading algorithms has had a major impact on the world of forex trading. This article explains the global arena of forex algorithm trading. It focuses on the most effective machine-learning approaches. All of them are used in the development of creative and profitable trading systems.

Introduction

Forex algorithm trading, often known as algo trading, It is the practice of using computer programs to execute trades in the foreign exchange market. The implementation of artificial intelligence into algo trading has transformed how dealers approach the market in the past few years. Methods for machine learning, which enable computers to learn from data and adapt to shifting circumstances, have provided new opportunities for dealers to improve their tactics.

Machine Learning’s Influence on Forex Algorithm Trading

Machine learning provides a multitude of ways to improve the precision and profit of FX trading algorithms. In this section, we will look at some of the greatest machine learning approaches utilized in forex algorithm trading:

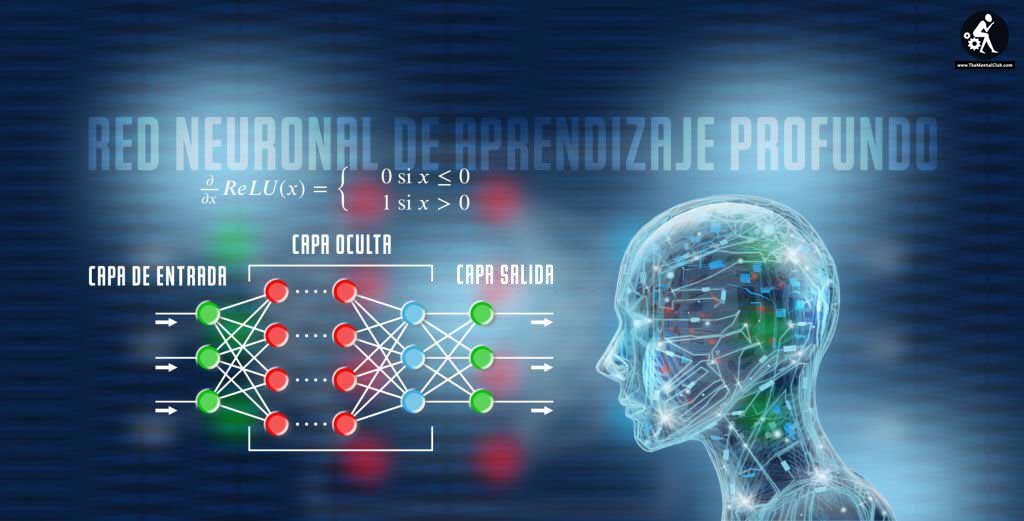

Neural Networks for Pattern Recognition

Neural networks, a form of artificial intelligence, excel at recognizing complicated patterns in enormous amounts of data. In forex algorithm trading, neural networks may scan historical price data, technical signals, and even news sentiment to detect trends and prospective possibilities for trading. These networks can be trained to forecast future price fluctuations, assisting traders in making educated choices.

Support Vector Machines (SVM) for Classification

Support Vector machine learning models are used for categorization tasks like estimating whether the price of a pair of currencies will rise or fall. Traders can use past data to train SVM models to learn the relationships between different market indicators and price movements. Once trained, the SVM can classify fresh data points and help with buy/sell choices.

Reinforcement Learning for Adaptive Strategies

The method of reinforcement learning entails teaching algorithms to make a series of judgments through trial and error. The reinforcement learning technique can be utilized to construct adaptable trading strategies in forex algorithm trading. The machine learning system learns from its mistakes and accomplishments, gradually refining its decision-making process in order to maximize earnings while avoiding costs.

Time Series Analysis with Recurrent Neural Networks (RNN)

Time series data, a fundamental component of forex trading, can be effectively analyzed using Recurrent Neural Networks. RNNs take into account the sequential nature of data, making them suitable for predicting price movements over time. They are particularly useful for short- and medium-term trading strategies.

Genetic Algorithms for Strategy Optimization

Genetic algorithms emulate the process of natural selection to evolve and optimize trading strategies. Traders can define a set of trading rules as genes, and the algorithm generates a population of strategies. Through successive generations, the algorithm evolves strategies that perform well under different market conditions.

Natural Language Processing for News Analysis

In the era of digital information, news and sentiment play a crucial role in forex market movements. Natural Language Processing (NLP) techniques can be employed to analyze and extract insights from news articles, social media posts, and financial reports. By understanding market sentiment and reactions to news events, forex trading algorithms can make more informed decisions, especially during times of high volatility.

Ensemble Methods for Enhanced Robustness

Ensemble methods combine multiple machine learning models to improve prediction accuracy and reduce the risk of overfitting. In forex algorithm trading, combining the predictions of various models using techniques like bagging or boosting can enhance the overall robustness of the trading strategy. Ensemble methods help mitigate the impact of individual model weaknesses and contribute to more consistent performance over time.

Conclusion

The integration of machine learning techniques into forex algorithm trading has ushered in a new era of sophisticated and adaptive trading strategies. Neural networks, support vector machines, reinforcement learning, recurrent neural networks, genetic algorithms, natural language processing, and ensemble methods are powerful tools that empower traders to navigate the complex forex market with precision and agility. As the forex landscape continues to evolve, the harmonious synergy between machine learning and algorithmic trading remains instrumental in shaping its future.

By harnessing the potential of these techniques, traders can not only optimize their trading strategies but also gain valuable insights into market trends and sentiment. As technology advances and datasets grow, the role of machine learning in forex algorithm trading is expected to expand further, driving innovation and creating new opportunities for traders to achieve success in this dynamic and ever-changing arena. However, besides knowing these things, anyone wants to form a crypto company can learn from here.

BitReview.io is a significant site in the fast-growing world of cryptocurrencies and blockchain technology in general. With the bitcoin market expanding at an unprecedented rate, there is an urgent need for trustworthy information and insights that can educate both rookie and experienced traders. BitReview.io serves this function as a comprehensive resource hub, providing a plethora of reviews, analyses, and educational information that explains the complexities of cryptocurrencies, exchanges, wallets, and related services.

By providing unbiased reviews and well-researched analyses, the platform empowers users to make informed decisions, mitigating the risks inherent in this high-stakes environment. BitReview.io is not merely a repository of data; it is a compass that aids in navigating the complexities of the cryptocurrency universe, fostering greater transparency, trust, and confidence among investors, traders, and enthusiasts alike.