With contactless payment technology, customers can initiate in-person transactions without having to physically swipe or dip their credit or debit cards at checkout. Thanks to their enhanced speed and security, contactless payments were already trending prior to the pandemic.

With social distancing guidelines still in place, contactless payment technology has become even more critical to running a business. Regardless, it is important for merchants to stay current with this payment technology, as it is likely here to stay.

This article explores use cases for contactless payments and how they can help improve the shopping experience for merchants and customers alike.

Contactless payments at a glance

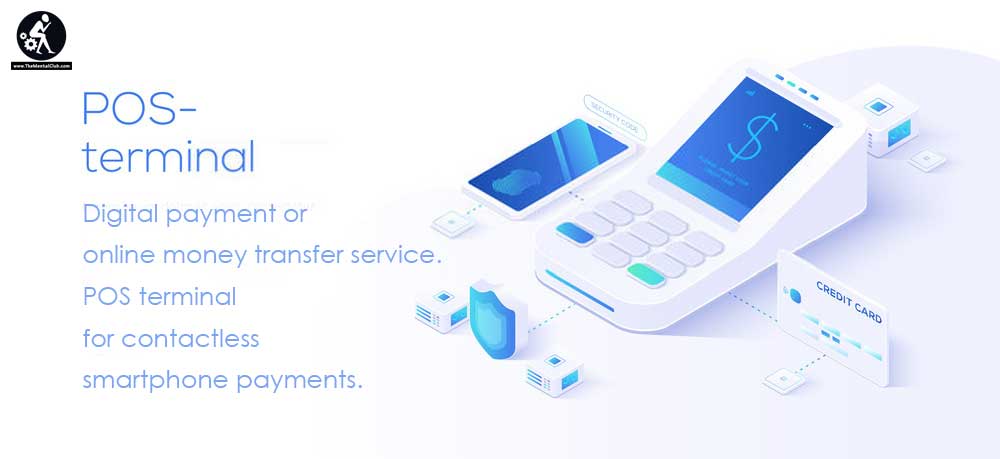

Before discussing the benefits of contactless payments, it’s important to understand how they work. The technology relies on near field communication (NFC) to establish a wireless link between the merchant’s point-of-sale (POS) reader and whatever card or smart device the customer is using to pay. NFC is similar to Bluetooth, except that its radio frequencies only work over very short distances.

When it comes time to pay, the customer waves his or her credit or debit card across the NFC-enabled reader connected to the merchant’s POS system. The customer can also use a mobile wallet on a smartphone or smartwatch – provided it has been preloaded with his or her credit card details.

At no time is there any direct contact between the buyer and seller, which is why contactless payments often go by their alternative names – “tap-and-go” or “tap-to-pay.”

eCommerce and in-app purchases can also be considered “contactless,” since there is no physical contact during the sale. In addition, a growing number of merchants now allow online ordering with contactless pickup and delivery options.

How contactless payments improve the shopping experience

There are several benefits of contactless payments for both sides of each transaction:

- They’re up to 10 times faster than traditional payment methods since most of the time there’s no need to swipe, sign, or enter PIN codes. This can translate to shorter lines for customers and more sales per hour for merchants.

- Contactless payments can help reduce fraud, especially when using smart devices to initiate payments. That’s because users must unlock their phones or wearables before making a purchase, and the sensitive payment info is encrypted within the mobile wallet.

- With fewer consumers carrying cash, contactless payments help provide an easier and more convenient way to buy in person. Merchants can still accept paper money and traditional plastic, though adding another payment method like contactless can help attract more customers.

Infographic created by Clover Network

In 2020, however, a new benefit emerged.

Contactless payments help provide peace of mind at a time when so many are worried about germ transmission. By minimizing physical contact, merchants are able to better protect their staff while providing a much safer shopping experience for their customers. The fact that contactless payments are projected to increase by 800% from 2020 to 2024 suggests this technology could become the standard for in-person transactions – even after the pandemic subsides.

Any payment option that helps speed transactions, generate more sales, and keep people safe is one worth exploring. If your payment environment isn’t set up to deliver these benefits, it may be time to make the switch.

For a deeper exploration of contactless payment technology and use cases, be sure to check out the accompanying resource.