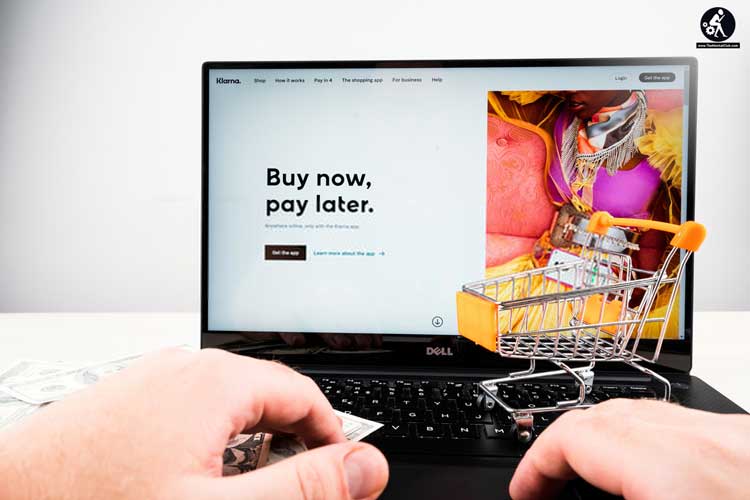

BNPL – Buy Now Pay Later. ECommerce is on the rise. The selection of its innovations has outperformed levels not anticipated until 2025. And one of the patterns fueled by widespread Purchase presently, pay afterward (BNPL) arrangements. As the world sank into an uncommon financial circumstance, BNPL spared the day, empowering millions of individuals around the world to manage items beyond a reasonable doubt required within the middle of the lockdowns and monetary difficulty.

Buy Now Pay Later (BNPL)

Purchase Presently Pay Afterward: how it works In its basic frame, Purchase presently pay afterward benefit is comparable to employing a credit card or getting a delicate credit. This could be a more convenient pay afterward shopping strategy in which clients make online buys without paying the charge at checkout. The method is essentially disentangled to guarantee that clients get the advance rapidly and effortlessly. The credit ought to be paid back on time to dodge late installment expenses and influencing your credit score.

The challenge of Purchase Presently Pay Afterward for business Earlier amid the onset of the widespread episode, online deals expanded by 16%. But, within the same period, online extortion cases too developed by 30%. With the development in extortion, governments around the world actualized strict cyber measures to guarantee that e-commerce stages and BNPL administrations suppliers are in full compliance with the law. Software advancement companies like Significant have ventured up their exertion to ensure information security among fintech administrations suppliers.

We offer program and item advancement administrations to companies in different segments, counting the fintech space. As of late, Significant created a SaaS stage to assist UK homebuyers to get contracts, discover protection suppliers without going through a part of printed material.

Normal highlights of a Purchase Presently Pay Afterward app Below are the key highlights of Purchase presently, pay afterward administrations that you simply ought to incorporate as you work on money-related app advancement projects: Loan terms – depending on the BNPL benefit supplier you employ, a few offer soft loan alternatives that are repayable after a few of weeks to some months.

Some high-value buys may have a reimbursement period of more than two years. Convenience – the method of applying for credit and getting endorsed takes a number of minutes. This is often done so rapidly that the method can be started whereas the client is at the point of deal or around to checkout (in the event that it’s online).

5 current patterns in versatile payments Mobile wallet pay installments had a direction of 80% increment from 2015 to 2020. The later worldwide spread pushed the development indeed higher due to expanded online deals. This segment will proceed not as it was developed but to alter the way of conducting commerce. Underneath are a few of the patterns on long-term or versatile payments.

How to actualize BNPL in your store

As customers are turning to BNPL administrations as a favored way of shopping online, eCommerce companies ought to consider the ‘buy presently pay afterward for business’ show as a way to maximize their income.

Underneath are a few of the ways to effectively execute a pay afterward app advancement extension for your online store: Point of deal integration – you wish to utilize a provider that gives a BNPL benefit that effectively coordinates into your checkout preparation to guarantee a smooth buying involvement.

The shipper will kill the requirement for a manual handle of the information section, and the client will rapidly get the checkout handle. That creates the buying handle simple for both the client and the merchant.

Experienced fintech program advancement administrations

Suppliers will guarantee that they develop an app that’s solid for taking care of and preparing exchanges. Underneath are ways to guarantee a secure Purchase presently pay afterward app improvement process:

Consolidate security at all stages of the advancement prepare –

amid the Pay afterward app improvement preparation, software engineers ought to consider building a few security layers so that the app’s information is continuously kept secure. This makes a difference to control and conceivably restrain too touchy information.

Data encryption –

Scrambling information can offer assistance to diminish the hazard of an effective cyber attack. It ought to be famous that information put away on the web isn’t so secure. It should be scrambled to play down the harm of such an assault. This is often why the Pay later app improvement handle ought to incorporate the integration of dependable encryption highlights. The stage ought to scramble information at each organization of information dealing with and processing.

Two-factor confirmation –

Two-factor verification has ended up the standard for online exchanges. You would like to guarantee that clients completely believe your app to handle touchy data, e.g., any connected credit cards. Having two-factor verification built into your app can twofold your app security and offer assistance clients see your application as exceptionally secure.

Gradually, long-term businesses show up to be online, with models built around versatile arrangements and experience. Usually making a difference to them to remain competitive by advertising pay afterward shopping arrangements to clients.