FinTech applications are evolving rapidly, laying the foundation for fierce competition in the market. In a digitally savvy world, a business can only win if they are advanced with technologies and solutions. Selecting the right technology stack is a critical decision that can significantly impact the success of applications. Among many options, Node.js has emerged as an outstanding choice, leading to the adoption of Node.js app development services, offering a versatile and efficient platform for developing various FinTech applications. In this blog post, we will delve into the reasons that make Node.js the ideal fit for FinTech development and explore a curated list of FinTech apps that vividly showcase its capabilities.

1. Speed and Scalability

Node.js is renowned for its non-blocking, event-driven architecture, making it exceptionally fast and scalable. In FinTech, where real-time processing and responsiveness are paramount, Node.js stands out by efficiently handling numerous concurrent connections. This speed advantage ensures FinTech applications can deliver prompt responses and updates to users, enhancing the overall user experience.

2. Single Language Stack

A distinctive feature of Node.js is its ability to enable both server-side and client-side applications to be developed using JavaScript. This uniformity in the development stack fosters seamless collaboration among developers, streamlining the development process and reducing potential friction between different application parts. This cohesive approach contributes to greater efficiency and code maintainability.

3. Community and Ecosystem

Node.js boasts a vibrant and active community that consistently contributes to its rich ecosystem of modules and libraries. This extensive collection of open-source tools accelerates development, ensuring FinTech applications can leverage cutting-edge solutions. The community-driven nature of Node.js also means that developers have access to a wealth of knowledge and support, fostering a collaborative environment for innovation in FinTech.

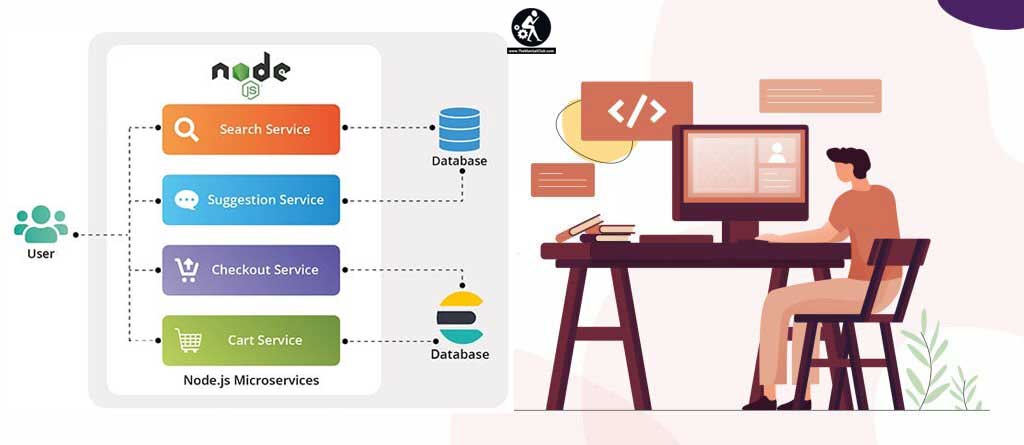

4. Microservices Architecture

FinTech applications often require a modular and scalable architecture to meet the demands of a dynamic and evolving industry. Node.js aligns perfectly with the microservices architecture, offering a lightweight and modular design. This allows developers to build and maintain independent, specialized services seamlessly integrating into the larger FinTech ecosystem. The modular nature of Node.js facilitates easier scaling and updates, ensuring that FinTech applications can adapt to changing requirements.

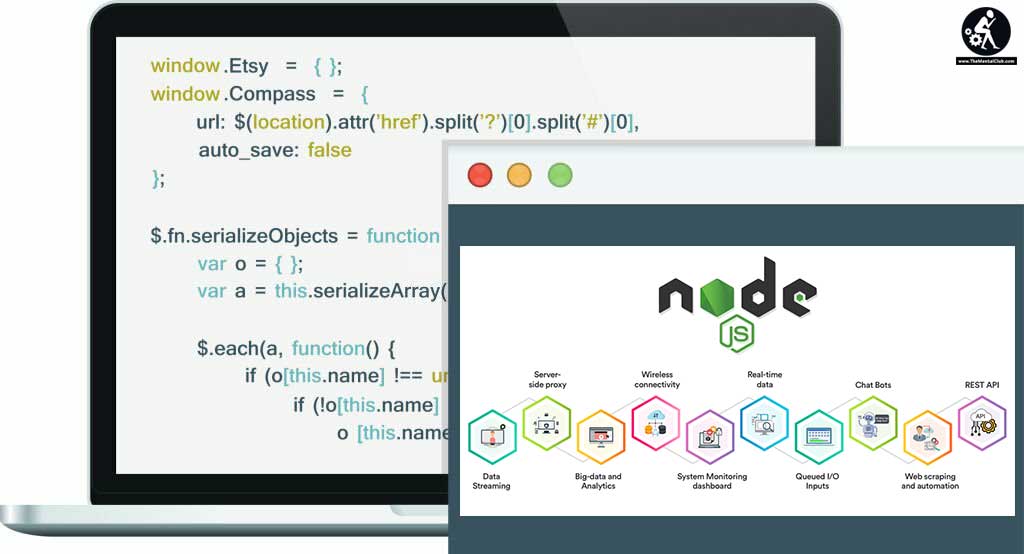

5. Real-time Capabilities

Real-time updates are crucial in FinTech, especially for applications dealing with stock trading, payment processing, and financial analytics. Node.js facilitates real-time communication through technologies like WebSocket, enabling responsive and dynamic FinTech application development. Whether real-time stock market updates or instant payment confirmations, Node.js empowers FinTech developers to deliver timely information to users, enhancing the overall reliability of applications.

Top FinTech Apps That Node.js Power

Now, let’s delve into a curated list of FinTech applications that exemplify the prowess of Node.js:

1. Robinhood

Robinhood disrupted the traditional brokerage model by offering commission-free trading. Its real-time stock trading platform leverages Node.js to provide users with instant updates on market changes and seamlessly execute trades. Using Node.js ensures that Robinhood’s platform can handle a high volume of concurrent transactions efficiently, contributing to its success in democratizing finance.

2. Stripe

Stripe is a leading online payment processing platform and relies on Node.js for its backend services. The platform’s agility and efficiency are evident in its ability to handle payment transactions securely and at scale. Node.js enables Stripe to process payments in real-time, ensuring a seamless experience for businesses and consumers alike.

3. Plaid

Plaid, a financial technology company, utilizes Node.js to power its API infrastructure. This enables developers to integrate with various financial institutions, access banking data securely, and build innovative financial applications. The use of Node.js in Plaid’s architecture contributes to the platform’s flexibility, allowing developers to create tailored financial solutions that meet the diverse needs of users.

4. Adyen

Adyen, a global payment company, employs Node.js to deliver a seamless and scalable payment processing platform. The real-time nature of Node.js ensures quick and secure payment transactions for businesses worldwide. Adyen’s use of Node.js reflects its commitment to providing a reliable and high-performance payment solution that meets the demands of the global market.

5. Acorns

Acorns, an investment app focused on micro-investing, relies on Node.js for its backend services. The platform seamlessly processes small transactions, making investing accessible to a broader audience. Node.js enables Acorns to handle many microtransactions efficiently, contributing to the platform’s success in encouraging users to invest their spare change.

Conclusion

Node.js has proven to be a transformative force in FinTech, offering unparalleled speed, scalability, and real-time capabilities. As showcased by the success stories of industry giants like Robinhood, Stripe, Plaid, Adyen, and Acorns, Node.js empowers developers to build innovative and efficient FinTech applications that cater to the evolving needs of the financial industry. As the FinTech sector grows, hence a need for an experienced and professional node.js app development company. Node.js remains a steadfast choice for those seeking to develop cutting-edge, high-performance financial applications. To leverage its unique advantages, hire a professional node.js app development agency that helps you connect and, combined with a thriving community and ecosystem, position your Node.js -powered fintech application as a transformative innovation in the finance industry.