The world we are living in is changing in response to the blockchain, as well as the cryptocurrency market presents opportunities the world has never seen. As a result, we’re left wondering how to mine cryptocurrency.

Cryptocurrencies like Bitcoin and Altcoins Like Litecoin, Matic, Dogecoin have a lot to teach us. Their origins, operation, and prospective impact on the future of our civilization, among other things.

But now we’ll talk about cryptocurrency mining, which is among the most crucial aspects of their growth.

Let’s look at how traditional currencies get into circulation to discover how cryptocurrencies get started.

What is Bitcoin Mining?

Bitcoin mining is the process of validating crypto transactions by solving complicated mathematical equations. Miners receive a fraction of a Bitcoin in exchange, allowing more currencies to be released onto the market.

As a result, there are two primary motivations for Bitcoin mining:

- Block rewards will be used to inject more Bitcoin into the market.

- To resolve the issue of double-spending by validating transactions.

One of the most important features of Bitcoin is that there is a limit to the number of coins that can exist – 21 million. With 900 new Bitcoin being generated every day, about 90% of them are already in circulation. No one can create more Bitcoins once all of them have been issued.

However, as the amount approaches 21 million caps, mining becomes more difficult.

The amount of Bitcoins produced from mining a block is cut in 50% every four years. In the crypto industry, this is referred to as halving.

The prize for the first Bitcoin transaction was 50 BTC. In 2012, the prize was reduced to 25 dollars. In 2016, it was reduced to 12.5, and in May 2020, it was reduced to 6.25 BTC per block.

In 2024, the Bitcoin block-mining incentive will halve to 3.175.

The halving is intended to reduce the number of released BTC, while demand remains stable, allowing the price to rise in general. Miners will no longer accept block rewards once all BTC has been mined, but will instead be compensated through transaction cost.

However, not all cryptocurrencies necessitate transaction validation through mining.

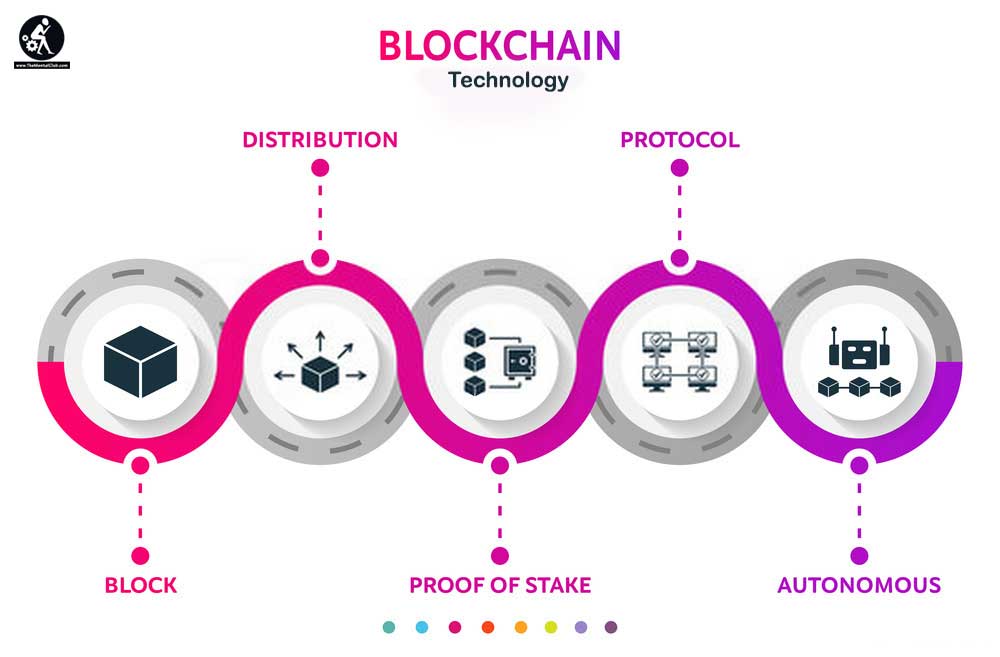

The Proof-of-Work model is what Bitcoin employs. However, that isn’t the only consensus algorithm available. Coins like NEO, Tezos, Cosmos, Cardano, and EOS use a Proof-of-Stake system (or a version of it) instead of PoW. As a result, they are stacking coins rather than mineable cryptocurrencies.

Understanding Proof-of-Work and Proof-of-Stake

One of the most important aspects of blockchain technology is the Proof of Work (PoW) system. Most cryptocurrencies, like Bitcoin and Ethereum, utilize it. However, with Ethereum, things are changing.

The Developing team has been announcing for years that Ethereum will switch from PoW to PoS, and that the transition will begin in December 2020. With the completion of Etherum 2.0 in 2022, the community expects Ethereum to fully transition to PoS.

Despite the fact that Ethereum Staking has been available since December 2020, stakes are not currently verifying Ethereum transactions. However, transaction validation and transfers will be possible once Ethereum 1.0 docks as a parachain to Ethereum 2.0 in 2022.

How does PoW work?

We’ll go through the algorithm in greater detail because Bitcoin is the most well-known cryptocurrency that uses PoW.

A memory pool is used to store all of the transactions on the Bitcoin blockchain. And each and every one of these transactions must be verified.

This is where the mining industry comes into play.

Every block in the blockchain has a 64-character encryption hash value that the miner must figure out. The transactions can then be verified and added to the next accessible block.

Miners employ sheer computational power to determine the hash value of the previous block.

Their system tries each number until it discovers the entire hash value. When a miner discovers something new, he broadcasts it to the network so that other nodes can verify it and generate a new block.

One of the PoW algorithm’s key advantages is its resistance to attacks. To successfully attack a huge PoW system, you’d need to control 51% of the network’s processing power.

As well as the costs of doing just that would be more than the potential benefit from the entire attack.

Individual miners are finding it hard to keep track with the ever-increasing demand for computational power. Significant and ongoing investments are required to upgrade their rigs. This increased the centralization of mining rigs, which goes against the blockchain’s core idea of decentralization.

How does PoS work?

While a more powerful rig is required to mine quicker in a PoW system, this is not the case with a PoS system. A person’s holdings of coins can be used to validate block transactions.

Because all crypto coins have already been produced in PoS systems, there is no need to create new ones. This eliminates the need to handle complicated riddles while also saving a significant amount of energy.

The way users earn cryptocurrencies is another distinction between the two methods. In a PoW system, miners are compensated with segments of their mined block as well as transaction fees, whereas in a PoS system, users are only compensated with transaction fees.

A minimal stake and device are required to run a nodes in a Proof of Stake ecosystem.

The minimum stake varies for each network and is particularly dependent on the value of the network’s coin. To start a Tezos staking node, you’ll need 32 ETH and 8,000 TZX.

In general, a laptop might accomplish the task, but putting it up can be difficult, and maintaining a node necessitates uptime.

Those who don’t want to set up their own staking node can simply acquire a hardware device with a pre-installed node from companies like AVADO.

You can also delegate your stake rather than running your node in various staking scenarios. You also won’t have to be concerned about downtime.

Which one is better?

Whereas the POW algorithm is widely thought to be safer, PoS is a more scalable option with a superior long-term strategy.

Even though some believe PoS systems are more vulnerable to a 51 percent attack, this will generate significant price changes in the coin. It might not even be worth it, given the stakes involved in successfully attacking the network.

Even yet, picking a winner is difficult.

However, as Ethereum moves from PoW to PoS and the energy conservation trend continues, Proof of Stake is becoming increasingly popular.

Nevertheless, Proof of Work appears to be far from over. Bitcoin is the most popular cryptocurrency, and leaders such as Elon Musk are aiming to sponsor energy-efficient solutions to reduce BTC mining’s resource usage.