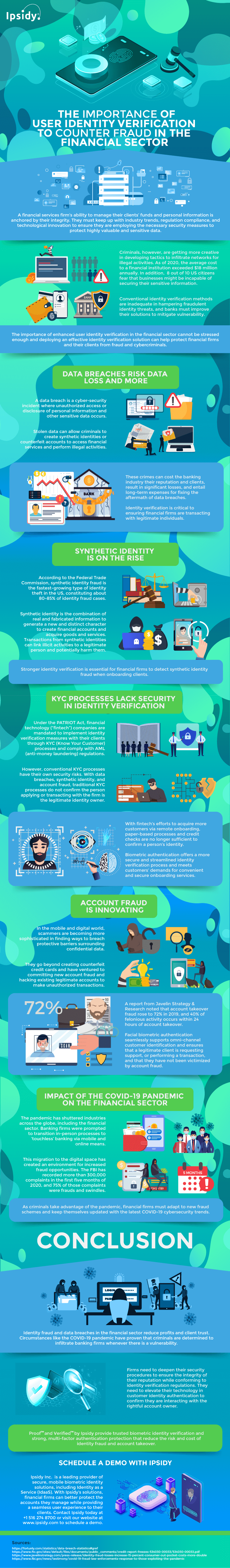

Identity verification is a vital requirement across critical sectors in the U.S., including the financial industry. It is an essential component of the USA PATRIOT Act’s Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations to deter criminal activities.

This customer authentication process ensures that firms are interacting only with authorized persons whose intentions for using financial services are legitimate. Many fraudulent individuals try to circumvent security measures to gain access to valuable information and funds protected by these establishments.

When criminals are able to fraudulently access data, they can use the stolen information to impersonate real customers or create a synthetic identity. Moreover, they can conduct illegal activities on behalf of a legitimate individual if they manage to hack into existing accounts.

Failure to keep the network secure from these illicit activities entails multi-million-dollar losses and customer distrust, which can take a long time to recover fully even if the issue was already resolved. Because of these persisting threats, a great majority of U.S. citizens fear that enterprises might be ineffective in protecting their valuable data.

With money-driven criminal motives on the rise, financial services institutions are required to adopt better anti-fraud measures, including the deployment of advanced technology for identity verification.

An ideal solution to these proliferating fraud cases is biometric identification. It uses inherence factors or a person’s biometric modalities like the face, iris, or fingerprints to verify their identity. This identity authentication method harnesses the power of the internet and mobile devices to expedite the verification process while maintaining security and accuracy.

For instance, facial biometric identification utilizes liveness detection features to ensure that the person is present in real-time during the authentication process. The individual may be asked to blink, move their head, or perform other gestures known only at the time of verification. Moreover, this facial recognition technology can distinguish inconsistencies in the image that indicates a fraudulent attempt.

The importance of employing effective solutions to mitigate fraud cannot be stressed enough. Fraudsters are vigilant for opportunities where they can proceed with their felonious motives.

In 2020, fraud cases surged because of the COVID-19 pandemic. The increasing usage of online and mobile tools for financial transactions has opened opportunities for fraud to take place.

As of September 30, 2020, the Federal Trade Commission has recorded 113,031 cases of fraud in the country. The top reports were attributed to online shopping, travel/vacations, credit cards, banks, savings and loans, credit unions, and credit bureaus.

Moreover, the report also revealed 31,035 cases of identity theft with criminal motives rooted in gaining incentives from tax, employment and wage, government benefits, and government documents associated with COVID-19 stimulus.

With quarantine measures still in effect, more and more people are opting for digital means to conduct activities. Even if banks are open, the long lines and limited hours can make in-person processes inconvenient.

Implementing a trusted solution for identity verification can protect enterprises in the financial sector from criminal attacks. For more information on the importance of using effective authentication methods to deter fraud in the network, below is an infographic by Ipsidy.