As a college student or parent of a student, you know all too well just how important it is to have a high credit score. Whether you’re buying a new car, first home, or other big-ticket items, having a good credit score makes everything much more manageable. However, if your score is not as high as you’d like, don’t panic.

In fact, by using a few simple techniques here and there, you may find your credit score can jump as much as 100 points within only a few months. If you’re searching for simple ways to improve your credit score, put the following ones into practice right away.

Pay Your Bills On Time

According to Ascent, paying your bills on time with private student loans is the quickest path to a higher credit score. Believe it or not, whether or not you pay your bills on time is the most significant factor that plays into your credit score. Since even a few late payments can stay on your credit report for over seven years, do all you can to pay your bills on time.

Keep Credit Card Balances Low

If possible, try to keep your credit card balances as low as possible. For example, try to use no more than 30 percent of your card’s total credit limit. Also, if you can pay down your card’s balance before the billing cycle ends, your creditor will report this to credit bureaus, increasing your chances of having a higher score.

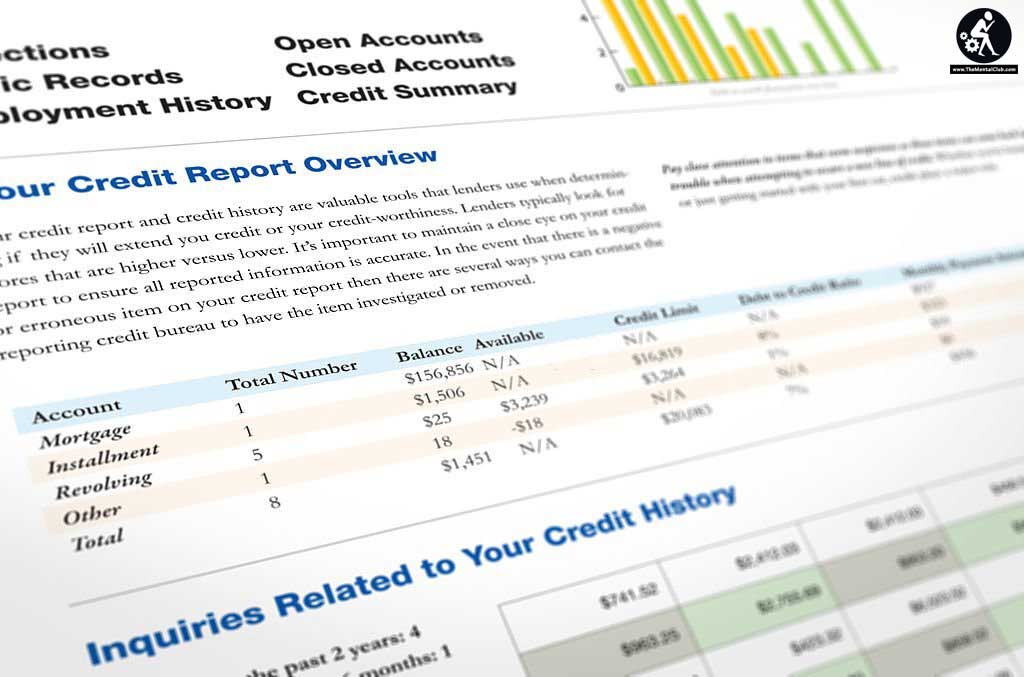

Check Your Credit Report

At least once each year, get a free copy of your credit report and look it over very carefully. On many of these reports, errors are included that can significantly lower your credit score. If you find errors on your credit report, dispute them immediately.

For example, if your report states you missed a few payments here and there when you did not, this could be a big reason why your credit score is so low.

Get Credit for Making Payments on Your Rent and Utilities

If you are like many college students and are renting an apartment while you finish school, work with credit reporting agencies so that it is noted on your credit report each month that you are paying your rent and utilities on time.

Contrary to your thought, not all credit scoring bureaus include these payments on reports. By making sure these payments get included in your credit report, you can get closer and closer to that 100-point improvement.

Diversify Your Credit

If you have a credit card or two, getting a car loan can help diversify your credit mix, which credit bureaus favorably. Along with your student loan, all of this should help increase your credit score, provided you remember to make your payments on time each month.

Once you start putting these simple tips into practice, it will be no time until you are staring at a credit score that is 100 points higher.