A home loan is a huge help when making high-value property purchases like a home or when building, renovating or expanding a home. Calculating the due EMIs is a crucial component of the loan planning process in this essential financial choice. The amount of money paid out in monthly installments influences how comfortably someone may pay off their mortgage without going over their allotted spending limit.

An EMI is what?

Both the principal amount and the interest paid on the mortgage are included in your monthly EMI. You typically pay more toward the interest component in the first few years of the loan duration. A larger share of the EMI is gradually shifted to the principal amount as you pay back the loan.

This is because EMIs are calculated using a declining balance method, which ultimately benefits the borrower. A house loan’s EMI is heavily influenced by the interest rate and loan term.

What is a calculator for home loan EMIs?

One of the best credit preparation tools for someone looking for housing financing is a home loan calculator. It assists in calculating the monthly payments necessary to pay off the debt in full. When you obtain a home loan, you pay back the borrowed money and the interest in smaller, more manageable monthly payments known as Equated Monthly Instalments (EMI).

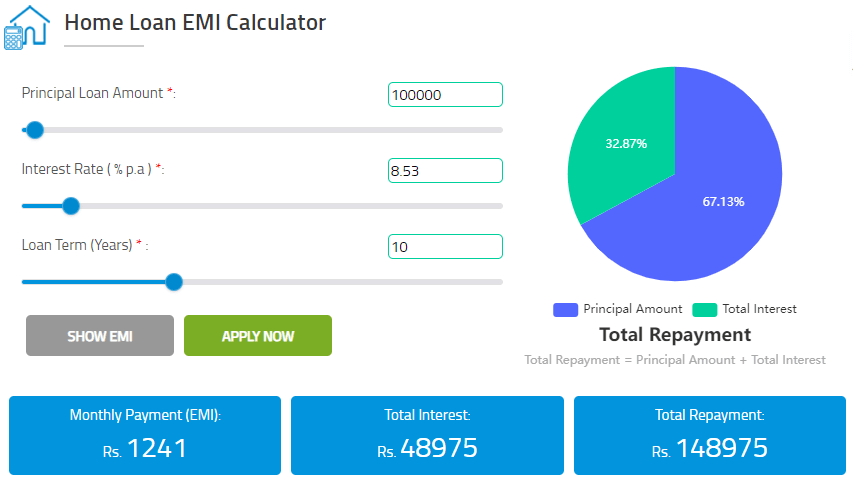

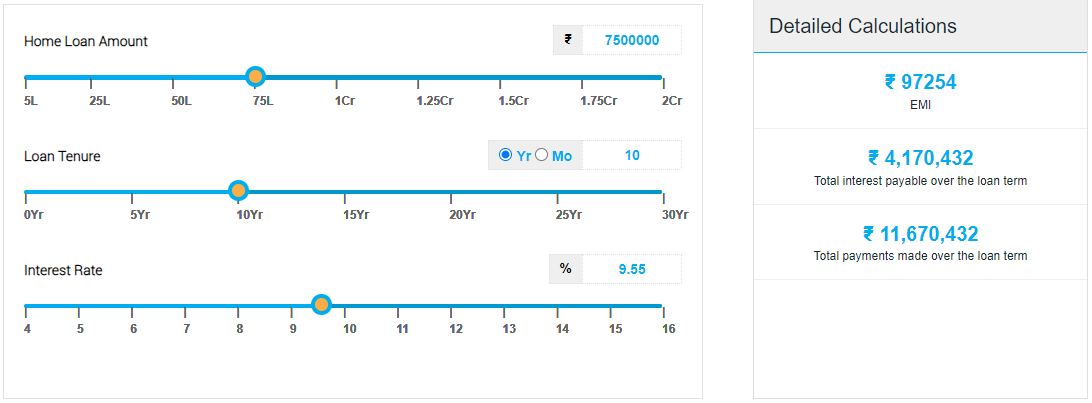

On the majority of lender websites, prospective home buyers may simply access an online home loan calculator. The intended loan amount, applicable interest rate, and preferred tenure can all be set by the user by entering the proper values or by adjusting a slider. When these details are entered, the calculator will quickly and accurately compute the results and display them on the screen.

Features and Advantages of an EMI Calculator for Home Loans

A handy tool with many helpful features and advantages is a mortgage loan calculator. These consist of:

Easy-to-use tool

People of all ages can use an online EMI calculator for house loans with ease. The loan amount, interest rate, and repayment period are the only three common factors you need to enter. The calculator will then perform the real calculation without any bother or difficult number crunching.

Cost of the Loan Divided Up

From the commencement of the loan duration until its conclusion, borrowers can view a comprehensive payback schedule. Along with the number of installments, due date, outstanding principle, and closing principal, the table also breaks down the components of principal and interest. A loan amortization schedule is a tabular form of this brief credit information.

It provides a thorough review of the full loan, assisting you in comprehending the actual cost of credit.

Compare and contrast

A loan calculator can be used to compare the loan programs offered by various financial organizations. You can choose the most practical solution by comparing the EMIs of each loan package and the overall credit cost. It helps you to calculate how much money you could save by choosing a specific lender.

Choosing the Correct Tenor

You can select the ideal loan tenure by being aware of the anticipated EMIs. You can extend the life of your loan if you want to pay your EMIs off less frequently. Your EMIs will remain within manageable bounds as a result. A tenor extension, however, gradually raises your EMI outlay. So, you might choose a shorter tenor if you want to pay off your loan as soon as possible and don’t mind making higher EMI payments. By limiting the amount of loan interest, you will reduce your overall debt load.

Successful Loan Management

Borrowers may accumulate additional funds during the loan term in the form of bonuses or matured investments, which can be used to partially or totally prepay their house loans. You can use a home loan calculator to determine when to start making prepayments in order to pay off the loan before the term expires.

Information Verification

You can use the calculator to confirm any lender’s repayment plan before entering into any negotiations regarding home loans. Due to lenders’ potential inclusion of additional fees and levies in the EMI calculation, the actual figures may occasionally differ from those projected by the online tool. When calculating the cost of the loan, borrowers must take these variations into consideration.

To Sum Up

Home loan calculations involve a lot of large figures. They can become complicated, time-consuming, and error-prone when carried out manually. A home loan EMI calculator is the ideal answer to these issues. Therefore, using this financial tool to prepare for housing credit is advised. You will be able to accurately calculate the necessary finances so that you can determine whether a loan is affordable. To customize the loan to preferences, one can also input several numbers for the home loan combination.